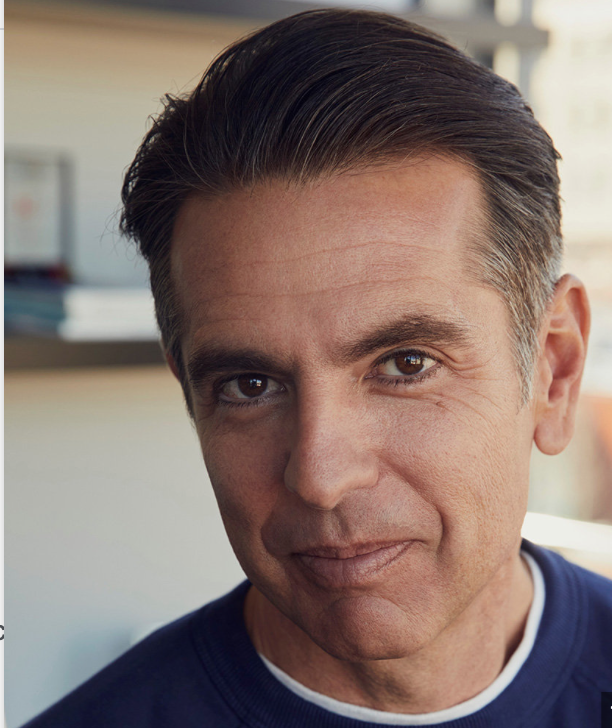

Although our speaker series has come to a conclusion in the classroom, I wanted to encourage everyone to continue the same act of seeking out advice and insight from notable people in whatever community you want to join professionally. I love listening to music business and technological innovative podcasts to stay informed on the current state of the market. Namely – Trapital – is a podcast hosted by Dan Runcie, that discusses Web3’s place in the music industry. Here are my takeaways from an innovator in the field I am partial to – Matt Pincus.

“the first ever diversified investment company focused exclusively on music businesses”

Let’s take entrepreneurs out of the traditional business archetype and redirect the definition to a niche line of work. Matthew Pincus is an American, music publishing investor who is making waves in the music industry from a business perspective. He is most notable for founding SONGS, an independent music publishing company, representing artists like The Weekend, Lorde, and Diplo in the repertoire. His strategy for acquiring old catalogs from major labels combined with his music startup focus leveraged him into a point of contention with majors. With his exit, “SONGS became one of the highest-returning investments in a startup music publishing company, generating a 27% IRR on a total capitalization of just over $20M.” However, setting aside his many various other ventures, Pincus has set his entrepreneurial mindset on a music investment firm with Liontree – MUSIC. Raising $200 million, this holding company will make long-term investments in music enterprises and startups, most commonly in combination with technology.

To quickly define: a holding company is an umbrella company (i.e. an LLC or another corporation form) that acquires and retains the authority of company interests. Those who are controlled are labeled, subsidiaries.

MUSIC’s acquisition intention will remain central to “[…]the technology sector, record labels and music publishers, and companies dedicated to Web3 innovation[…]” All in response to the oversaturation of financial and business influence in the industry. Pincus wants to return music from being described as an “asset” to “assembling humans.” Since 2019, MUSIC has invested in firms like Splice and DICE.

Splice: is a cloud-based music creation and collaboration platform […] which includes a sample library, audio plug-ins on a subscription basis, and integration with several digital audio workstations.

DICE: a ticketing platform that democratizes live music publication and accessibility

Pinus says “Goldman Sachs people think streaming will go up for forever”, he suggests this thought may have fault. His thesis area suggests that streaming introduces new modes and mediums to emerge with the purpose of connecting artists with fans. The relationship between in-country and diaspora movement of music is what he wants to address with this company. As a result, he wants to have his finger on the pulse of the music industry innovation.

Takeaways:

• Always manage the working capital of the business

• Understand the market you are interested in and discover how many deals you can make

• Two types of music business employees: “people who came up through the building” and “feed in the wild”

• Systematic A&R: “Find reoccurring success through longevity and development – funnel of a group of things that might work”

• Majors’ Perspectives: “Seeing the shiny pennies and grabbing them no matter the cost and paying a lot for something predictable”

• Independents’ Perspectives: find artists really early and develop them, what makes a good story in a good market

• There are not really enough good talented people in A&R: you have to know everybody and know how to create a feeling

• Music technology: people are learning equipment quicker, democratizing music

• All about digital marketing

• “I went to Columbia business school and I didn’t get one job interview coming out of the school, no one trains you.”

• There are opportunities to bring in outside capital […] in a nonconventional way

• What makes an entrepreneur – brings on really good talent

• Theme: How do we make music more usable

• Everyone provides value

• “It takes a village to build valuable stuff.”

• Entity formation: aka partnership; this is where the music industry is headed