As a student currently participating in the MIS BBA/MAcc Double Dawgs Program, the intersection point between accounting and technology is something that I have found very interesting. Since we are discussing Artificial Intelligence this week in class, I specifically wanted to research how AI is affecting accounting. Over the next decade, the value of Artificial Intelligence will be captured in all industries, including accounting. Broadly, the accounting industry is hopeful that AI can allow CPAs to find more career opportunities and allow them to work smarter, not harder. From the client’s perspective, AI will provide them with more value through deeper insights.

According to an article from Emporia State University, there are four ways that AI is currently affecting the future of accounting. First, there is the ability to automate accounting and bookkeeper activities. AI is expected to replace 40% of work in auditing, payroll, uploading files, accounts payable and receivable, inventory control, and other accounting functions. There is also a new evolution of “invisible accounting”. This idea is referring to the fact that AI can do compliance work while humans can be used in more valuable ways. AI is also helping accountants by delivering actionable insights. With internal and external data, AI can help executives make smarter decisions. Lastly, AI will be used in accounting as Robotic Process Automation gains popularity. RPA will decrease the need for human labor in the manual accounting process, allowing humans to spend their time on more meaningful work.

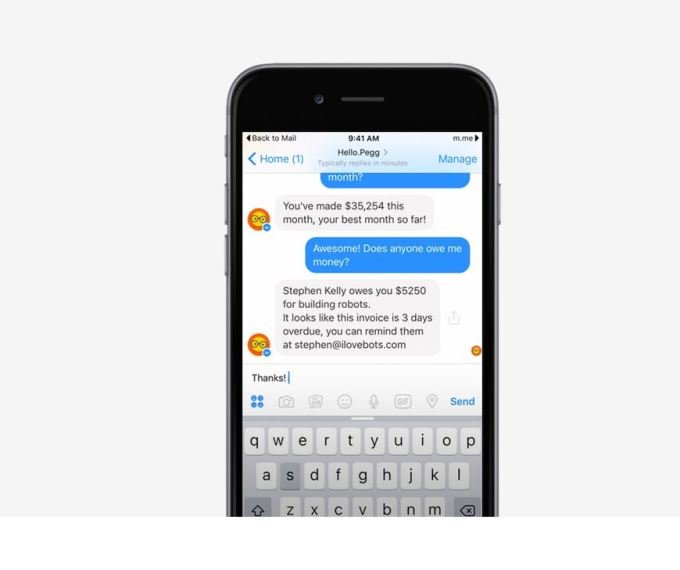

A fairly recent innovation in the accounting world is Pegg. Pegg is a smart assistant chatbot for accounting. Pegg can “help businesses manage everything from money to people by texting…through a familiar style messaging platform on their phone, tablet or laptop”. In 2018, Pegg was created by Sage, a cloud-based accounting software company. According to another article, “three-quarters of small businesses use excel or even paper to manage their accounts.” Now, they can use Pegg. By using Pegg, businesses decrease the burden of administrative work which allows their time and resources to be better used solving problems and providing value to their customers. Pegg’s target audience is small businesses because it provides them with a simpler and more convenient way to manage their administrative tasks.

For example, Pegg can be used to ensure expenses are recorded or to find the status of an invoice. A company can use Pegg within existing software like Facebook Messenger and ask questions as one would to Alexa. You could ask “who owes me money” and Pegg would respond. All companies need to track expenses and do tax returns, but very few people enjoy those things. Pegg gives these people a way to manage those things, so they have more time to do the things they love. Pegg has won awards like Best AI-Based Solution for Financial Services and Software Excellence Innovation Award. Pegg isn’t meant to replace the need for humans, but, rather, to expand the possibilities created for businesses when humans and machines can collaborate. At the end of the year, taxes would be much easier to file with Pegg because companies’ or individuals’ financial records would be better recorded throughout the year. Pegg is just one example of how AI is revolutionizing business and accounting. The biggest concern I have regarding Pegg is that it was created nearly five year ago yet most of the articles about it were from 2018-2020. I am curious to know the current progress of the chatbot because I think it has great potential.

Kriti Sharma is the Vice President of Artificial Intelligence and Ethics at Sage. She recognized the issue of AI reinforcing human stereotypes; therefore, when creating Pegg, she made the chatbot gender-neutral. An example of AI’s gender stereotype issue was shown through a study at Boston University. In this research study, an AI program was trained with text from Google News. “When the AI was asked, ‘Man is to computer programmer as woman is to X,’ the program’s response was “homemaker”. She blames some of the stereotype issues of AI on a lack of diversity on technology teams. Sharma said in an interview “a child growing up in an AI-powered world today could be learning to bark orders at a female voice assistant — I think we all would agree this is dangerous.” Due to Sharma’s efforts, Sage published an ethical code for developing AI. This article urges companies to build AI services to tackle social issues ethically. Because of these efforts and her work to create Pegg, she was named in the Forbes 30 under 30 list in Europe. Sharma should be recognized as a pioneer in making Artificial Intelligence ethical.

In addition to the ethical concerns of AI, there are more concerns with digitizing the accounting profession. Mostly, people are afraid of data privacy and confidentiality. The only way to gain value from AI is to have access to large amounts of data. Therefore, this need for data also creates privacy concerns. Furthermore, since AI’s algorithms are so complex, there is a lack of transparency with AI’s proposed solutions. It is often hard to understand how an AI program gets to a certain solution, which would make it hard to know if the AI is biased or bad. Although all of these concerns do need to be addressed, the opportunities AI will bring to the accounting world need to be pursued.

Additionally, in a world where technology is constantly evolving, the next generation of accountants need to be prepared to use Artificial Intelligence to help automate minute tasks and drive deeper insights.

Sources:

https://online.emporia.edu/articles/business/ai-and-future-of-accounting.aspx

https://tipalti.com/robotic-accounting/

https://theworld.org/stories/2018-03-28/meet-pegg-gender-neutral-robot-assistant https://www.linkedin.com/pulse/story-behind-pegg-building-worlds-first-smart-alex-fawcett