In today’s day, artificial intelligence is very crucial in helping make society flow more efficiently. In this blog post, I will go over how AI can be applied in various areas in the “financial industry” such as credit scores, fraud detection, investment banking, customer service, etc. I strongly believe that AI has the potential to transform the financial industry in many positive ways.

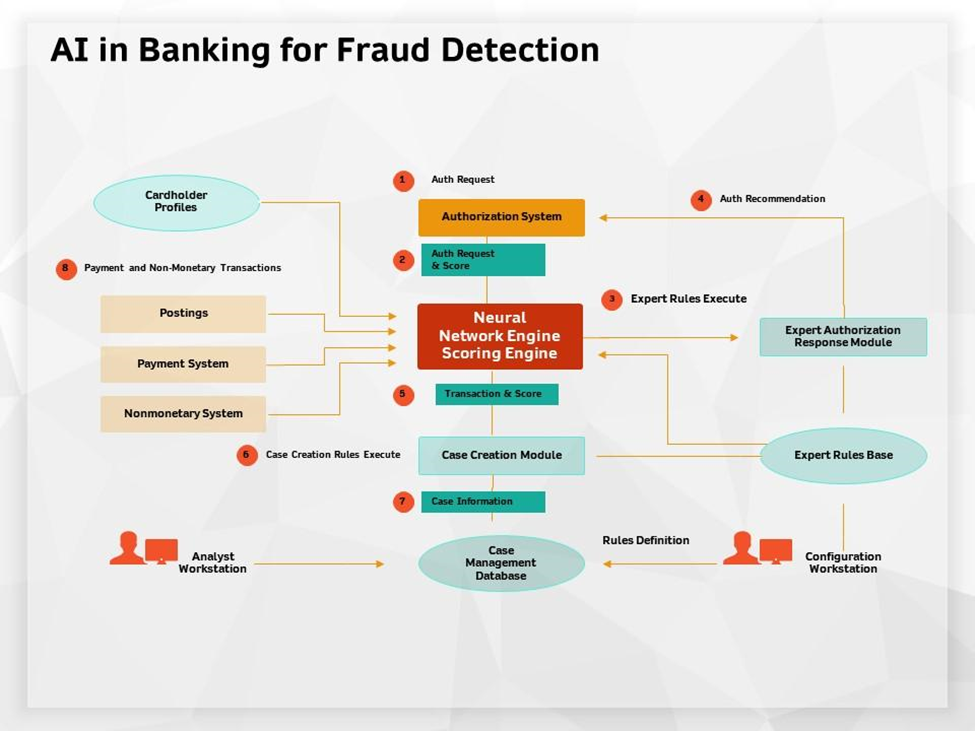

First off, one area where AI has been particularly effective is fraud detection. With the rise of digital banking and online transactions, financial fraud has become a growing concern for both customers and financial institutions. However, AI-based fraud detection systems can analyze large amounts of data in real-time to identify and prevent fraudulent activities, such as phishing attacks, account takeover, and money laundering. These systems use advanced machine learning algorithms to learn from past transactions and identify patterns that may indicate fraudulent behavior.

In addition to what has been said above, another area where AI is being used in finance is credit scoring. For a while, credit scoring has been based on a few key factors, such as credit history, credit length, income, etc. However, AI-based credit scoring models can incorporate a wider range of data sources, such as social media activity and online behavior, to create a more comprehensive and accurate picture of a borrower’s creditworthiness. This can help financial institutions make better lending decisions and reduce their risk of defaults.

Investment management is another area where AI is making a significant impact. AI-powered investment algorithms can analyze vast amounts of data and identify patterns and trends that may not be visible to human analysts. This can help investment managers make more informed decisions and achieve better returns for their clients. On top of this, AI can be used to automate various investment-related tasks, such as portfolio rebalancing and risk management, allowing investment managers to focus on higher-level strategic decision-making.

AI is also being used to enhance customer service in the financial industry. Chatbots and virtual assistants can provide customers with quick and personalized support, answering their questions and resolving their issues without the need for human intervention. This can help financial institutions reduce their operational costs and improve their customer satisfaction rates.

While AI has the potential to revolutionize the financial industry, its adoption also presents some challenges. One of the main challenges is data privacy and security. Financial institutions are responsible for handling sensitive customer data, and any breach or misuse of this data can have severe consequences, both in terms of financial losses and reputational damage. Therefore, financial institutions must ensure that their AI systems comply with relevant data privacy and security regulations and implement robust security measures to protect their data from unauthorized access.

Another challenge is the need for skilled personnel. Developing and implementing AI-based systems requires a team of data scientists, software developers, and domain experts, who have the necessary skills and experience to build and deploy these systems effectively. However, there is currently a shortage of skilled personnel in the AI field, which makes it difficult for financial institutions to find and retain the talent they need to develop and implement AI-based solutions.

To sum it all up, AI is transforming the financial industry in various ways, from fraud detection and credit scoring to investment management and customer service. While the adoption of AI presents some challenges, such as data privacy and security concerns and the need for skilled personnel, its potential to enhance operational efficiency and customer satisfaction makes it an attractive option for financial institutions looking to gain a competitive advantage. As AI technologies continue to evolve, we can expect to see more innovative applications of AI in the financial industry in the years to come.

Now, I’m curious to know what you all think about AI in the financial industry. With the rise of technology, we’re seeing more and more financial institutions implement AI algorithms to make predictions, analyze data, and even make investment decisions. But what are your thoughts on this? Do you think AI will transform the financial industry for the better, or do you have concerns about the potential consequences of relying too heavily on machine learning? I personally think that AI will transform the financial industry for the better, and I honestly don’t think that they will rely heavily on machine learning (not this early at least).

Sources: AI in Finance 2022: Applications & Benefits in Financial Services (insiderintelligence.com)