Hello Everyone! For this week’s blog post, I would like to talk about digital innovation in the Fintech industry. Have you ever used Venmo, Cash App, or Zelle to send money? All of those are examples of using Fintech to send out money. Gen Z and millennials see traditional banks as untrustworthy, and this is fueling growth in Fintech. The fintech industry is disrupting the banking industry and is growing at a fast pace. This growth has led to record-breaking venture capital investment. Venture capital investment in Fintech doubled from 46 billion in 2020 to a record 115 billion investment in 2021. Within the past year, growth has calmed down due to inflation and the current state of the economy.

What is Fintech?

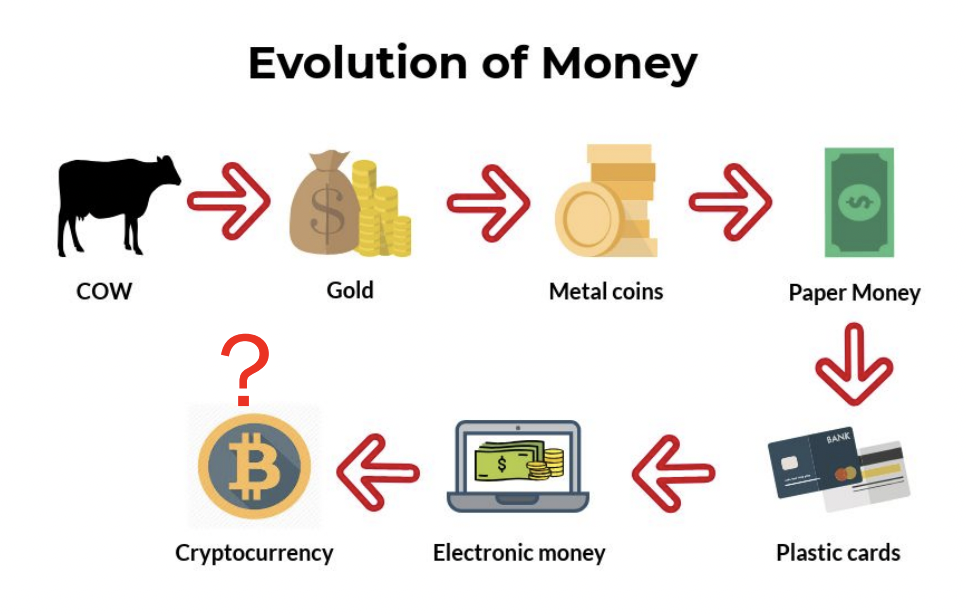

Fintech is a term meaning financial technology and is any technology that has the power to improve and automate work for the financial industry. The history of Fintech can be traced back to the 18th century. In 1866, the Pentelegraph was developed to verify signatures during banking transactions. Transatlantic cables and the Fedwire funds enabled the start of being able to send payments around the world. During the 1950s, credit cards were introduced as many people were tired of carrying cash around, and these included cards such as Diner’s club, Amex, and BOA. These events are known as Fintech 1.0 and is the first era of the fintech industry. The second era of the fintech industry is mainly led by traditional financial institutions such as banks. In 1967, Barclays set up its first ATM, and in the 1970s, the NASDAQ was created as the world’s first digital stock exchange. After this, SWIFT was created to solve the communication problem from cross-border payments. In the 1980s, bank mainframe computers were introduced, and this led to the growth of online banking. The 1990s is when digital banking came into fruition, and in 1998 Paypal was launched. Everything seemed to be going well until the 2008 global financial crisis. This pivotal moment would later be the reason for digital innovation in the years ahead. After the crisis, many people lacked faith in the traditional banking system, and this led to what is known as the third era of Fintech. This era began in 2009 when bitcoin was created. People started to use smartphones at this time, and millions of people around the world were able to start accessing the internet and using financial services. Venmo was launched in 2009 and was useful because it allowed people to be able to transfer money from their mobile devices. Other financial services, such as Google wallet and apple pay, were created in the following years.

The Future of Fintech

Over the past few years, many innovations have occurred in artificial intelligence, big data, and cloud computing. These innovations have helped increase efficiency and faster cash access around the world. Around 1.4 billion people in the world are unbanked. Fintech is becoming a necessary resource for many countries in Latin America, Africa, and Asia because it enables financial inclusion. The COVID-19 pandemic led to the growth of digital payments and is where underrepresented people began to use Fintech for financial services. In developing countries, many people rely on getting money from abroad. According to the world bank, 27 percent of Nepal’s GDP is from funds sent from family or community members. People in these countries rely on this money, and the development of Fintech and digital transfer apps has helped to alleviate poverty. The growth of Fintech is going to be driven by innovation to increase financial inclusion for all.

Challenges

The fintech industry today faces many challenges. One of the most significant issues is that Fintech has a gender inequality problem. In the U.S., a woman working full-time only makes 80.5% of what her male counterpart makes. This is a problem that needs to be fixed and will hopefully improve with time. The fintech industry has been male-dominated, but over the years, improvement has been made to have more female fintech leaders. According to a Mckinsey Study, companies with a large number of women in top management positions had a 41% higher return on equity than average. Female fintech leaders will not only close the gender gap but will also increase companies’ ROI.

Some other challenges include cybersecurity. Fintech companies have access to large amounts of user data and have to make sure that they have a high level of security to prevent cybercrime. Big Data and artificial intelligence is crucial for Fintech companies as these technologies will help to detect fraud and is vital to open banking being able to succeed. These technologies are challenging because they are hard to implement. Maintaining industry regulations is challenging, and each company must follow the guidelines as in the U.S., there are different compliance standards depending on the state.

Sources