In order to gain honors credit for this class, I have decided to target my blog posts around the theme of digital innovation within the accounting field. For my last blog post, I focused on how AI was changing the accounting field as a whole. This week, I wanted to research the digital transformation that is currently happening in the audit industry.

From my research, I concluded that the Big Four Accounting Firms are paving the way for digital innovation in auditing. Wes Bricker, PwC’s Vice Chair Assurance Leader, said that “automation is how technology can harness points in the audit process to achieve synergy between our people and the machines that they use, so that the sum is greater than those individual parts.” One example of how they are trying to achieve this synergy is PwC auditor Zachary Aronson’s automation of the reconciliation process. Prior to automation, this process required more than 20 hours of digging through spreadsheets. It can now be done within a matter of minutes. Aronson is now a part of a group at PwC that is completely dedicated to identifying ways technology can address different bottlenecks and pain points for their clients. Michael Conan, another PwC auditor, was able to streamline communication with clients by creating a dashboard that provides real-time updates of their audit work. Both of these examples show how PwC is digitally transforming their audit practice to derive benefit from the intersection of humans and machines.

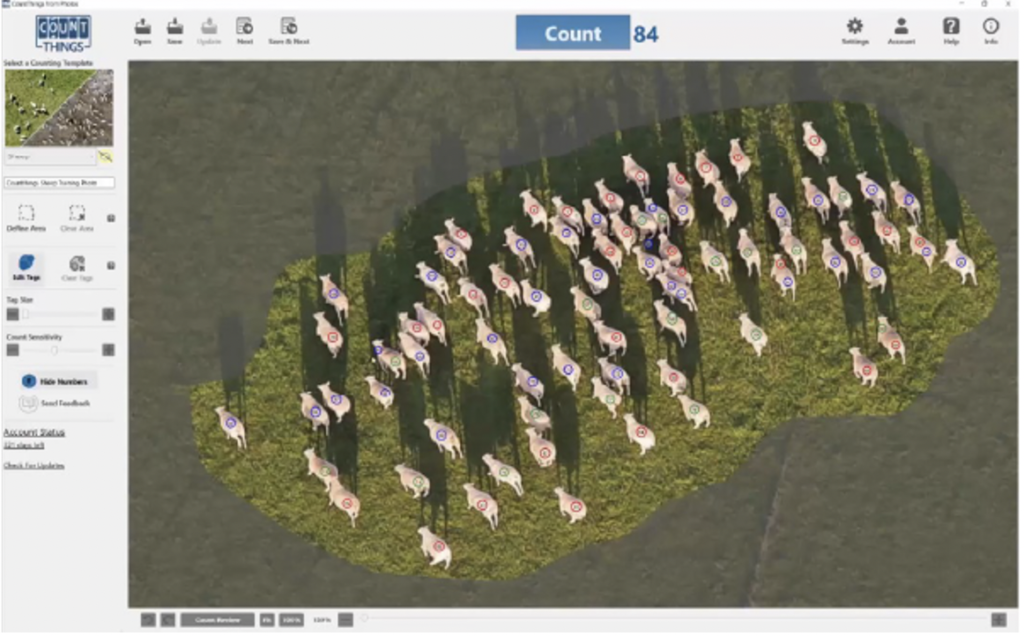

Last semester, I was able to see first-hand how EY was digitally transforming their audit process. EY’s Academic Resource Center (EYARC) published a case that my Accounting Information Systems and Data Analytics course (ACCT 5310) completed in class. This case uses a software called CountThings, and the purpose of the case is to show how auditors can use technology in the inventory counting process. Through this case, I learned how drones are revolutionizing this process because they are able to take pictures of the inventory in real-time, which can then be processed at a later time very efficiently. The case asks the students to act as a consultant and audit a sheep farm that owns approximately 3,000 sheep. We then used the CountThings software to count the number of sheep on several drone images. Although once the picture is loaded in CountThings it automatically counts the sheep, you still have to manual check that all sheep were located and accounted for. This case was a great example of how the prior manual work of auditors is being transformed. Overall, I learned that drones and software like CountThings are making the inventory counting process more efficient and effective.

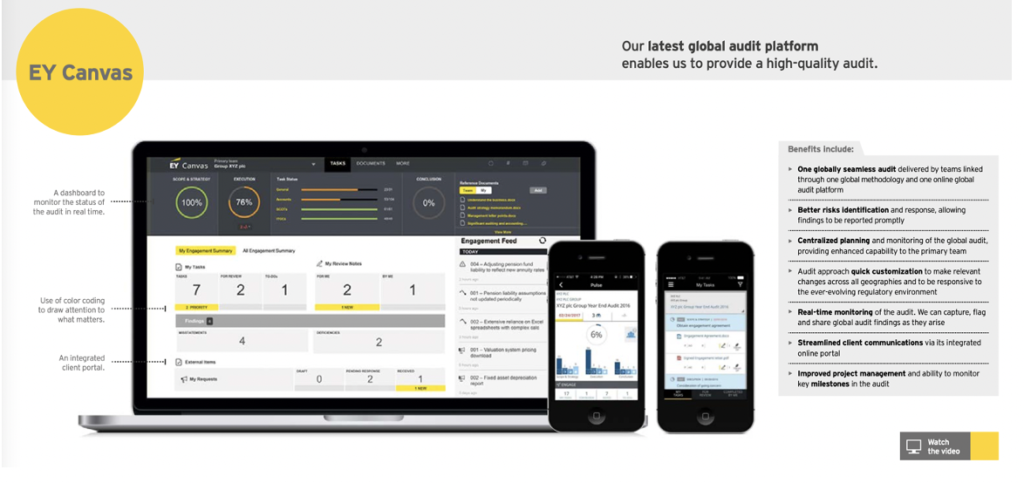

EY continues to be a leader in digital transformation of auditing with their innovation of EY Canvas. EY Canvas is a platform hosted in their private cloud that connects their professionals with clients when an audit is occurring. It is particularly useful in connecting a team across the globe and allows them to communicate and manage their audit work. Other benefits include better response times and real-time monitoring. Within this platform, there is also client portal. This feature streamlines client communication, which saves time for everyone involved in the audit. There is also better security of client data, which reduces many risks. EY also made EY Canvas a mobile application which means their clients can use it on the go increasing its benefits.

Big Data is another reason company are being forced to change their current auditing processes. Most companies are switching to advanced audit analytics tools in order to manage such large amounts of data. In addition, like I explained last week, companies can use AI to help identify and understand patterns and anomalies within data sets. From an internal audit perspective, this can be incredibly helpful in identifying risk and insights that the human eye would never be able to catch. Furthermore, companies have also begun using Robotic Process Automation (RPA) to make their audits “hands free”. RPA works by running application software the same way a human would use that software. By using RPA, their auditors can focus on more productive tasks.

Like we say in class, digitally transforming the audit process will not get rid of the need of auditors. However, auditors that understand and want to use the emerging technologies will replace those who do not want to. One article I read explained that one of the biggest obstacles slowing down this transformation is the fact that many auditors don’t have the skills needed to work with an automated audit process. They claimed that the skills of data analytics, programing, and acquaintances with emerging technologies are critical for the next generation of auditors. Thankfully, the Accounting Information Systems and Data Analytics course is required for all Accounting students at UGA. I think this is a very smart move because that class taught me so much about emerging technology in Accounting and gave me hands on experience working with relevant software. Terry College of Business is creating the new generation of auditors that are very needed in society.

https://countthings.com/case-studies/0004

https://www.ey.com/en_us/audit/technology/canvas

https://www.pwc.com/us/en/tech-effect/automation/audit-technology-and-digital-skills.html \

https://medium.com/ecajournal/smart-audit-the-digital-transformation-of-audit-b283e1653bd4