On my first day of spring classes freshman year, my accounting professor asked my class to describe the “typical accountant”. Through conversation, we ended up creating a fictional character named Bob. Bob was a white man in his 40s who drove a 2016 Subaru to his job at a big office building. He was an introvert, drank his coffee black, and wore glasses. I believe this exercise that my class did accurately reflects society’s view of who accountants are and the type of work that they complete.

I have never felt that I fit that stereotypical mold of an accountant. I would describe myself as outgoing, and I enjoy working with others. I’m ambitious, and I like to think outside the box. Before this class and my outside research, I never understood how I could use my unique traits to better the accounting field. After taking this course, my understanding of emerging technologies in accounting and certain people and companies leading this transformation has increased greatly. As the new wave of technology takes over the accounting world, I see the role of Blockchain, ChatGTP, AI, and Data Analytics increasing within the field. Specifically, I see technology revolutionizing the audit industry. Employers will start seeking out future accountants that know of these technologies and possess the skills to use them. Those accountants will be able to leverage those skills to achieve deeper insight and success for their companies and their clients.

I found our blockchain unit in this course particularly fascinating. Before our discussion, I was really confused about the idea of blockchain and how it could make an impact beyond crypto currency. Through class and my research, I learned about the public recording-keeping system that blockchain creates and the trust that it can instill in society. Tianhao Chen’s case study about Luckin Coffee and blockchain taught me about the role that blockchain can play in detecting fraud. I think this application of blockchain will be extremely relevant in the next couple of decades for accountants. Blockchain would create an independent and decentralized public set of books. Fraud would decrease because of this new system. Blockchain would also impact the role of auditors since auditors could trust their client’s information more.

Artificial Intelligence (AI) will touch and change every industry within the next couple of decades. The accounting field is not immune to this evolution. According to an article from Emporia State University, AI has the power to replace 40% of work in auditing, payroll, uploading files, accounts payable and receivable, inventory control, and other activities. These mainly administrative and bookkeeping tasks will be automated, allowing time for humans to dedicate to more meaningful work.

ChatGPT, an AI chatbot, has gained serious attention throughout this semester. On Twitter, I saw a CPA post about using ChatGTP to build comprehensive tax work papers. I never thought about this application of ChatGTP. It took her nearly 10 different prompts to get an output that could help her clients. This Twitter thread taught me to not buy too much into the hype of AI tools like ChatGTP, but it also taught me to continue to challenge these tools to help solve problems for you and your clients. I think as ChatGTP gets smarter, accountants should use it to build Excel tables and formulas to create complex solutions.

Pegg is another chatbot; however, it was designed to be used specifically for accounting activities. Pegg was created by the accounting software company Sage to help businesses manage administrative tasks, such as tracking expenses. By removing that burden on small businesses, companies can focus more of their time and resources on thought-intensive work. Pegg won the Best AI-Based Solution for Financial Services and Software Excellence Innovation Award. Pegg is one example of the way AI is already impacting the accounting world.

I believe that emerging technology within accounting has the potential to make the biggest impact within the Audit sector. Automation already has made hours of investigative work turn into seconds. AI has also made a huge impact on inventory counting. With the software CountThings, auditors can use the application to count inventory from drone pictures. Priorly, this work would have been done manually. This software significantly makes the audit process more efficient and effective. In addition, in a world of big data, auditors must adapt and use emerging technology to manage and review the immense amount of data. AI can help find patterns and anomalies in these big data sets. These advanced analytic tools could help find risks and insights that humans would never find.

Courtney Stout, Chief Privacy Officer at Coca-Cola, explained that growth comes from making informed decisions based on current data. This statement also implies the growth that accountants can help provide their clients. The use of data analytics is critical in current-day accounting. Accountants must be able to transform raw data into meaningful insights to help their clients. Because of data analytics, traditional financial reports can be given in real-time instead of simply every quarter. Data analytics can also help in risk analysis and mitigation.

Ryan, LLC uses data analytics to save their clients huge amounts of money. They use SQL to query through their client’s data and find transactions where they paid too much in taxes. They then use the results as evidence to collect money back from the IRS. Ryan, LLC is just one example of how data analytics can be used by accountants to help clients save money and reach their goals.

I also learned throughout the semester the importance for all businesspeople, especially entrepreneurs, to know accountants. I ended up on a lot of Twitter threats with CPAs that were frustrated with their client’s lack of accounting knowledge. For example, one client did not tell his tax preparer that he started an LLC because he didn’t think it would change anything from a tax standpoint. Entrepreneurs need to know accounting, so they know what kind of records or receipts to keep. They need to know what goes on a Schedule C and the tax rules, so they know how to get the most deductions and save money. Knowledge is power, and knowledge about tax is critical to the success of entrepreneurs.

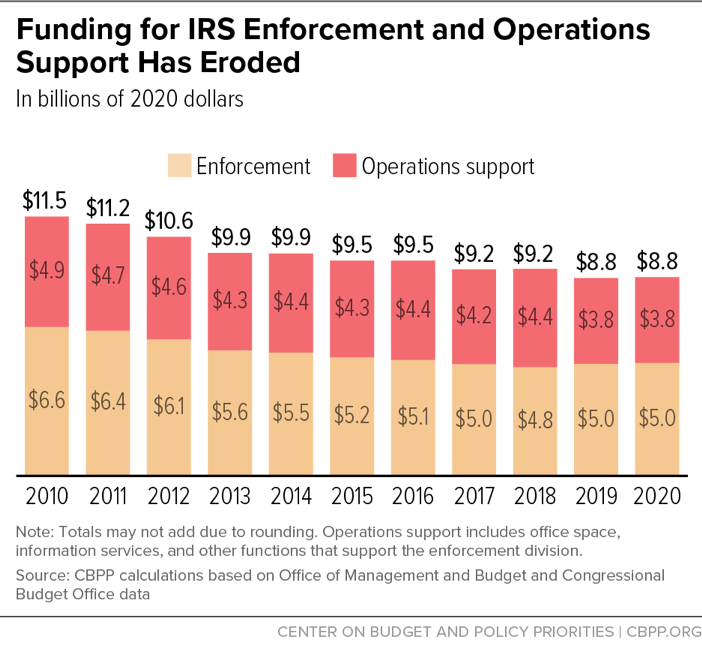

Lastly, Twitter taught me the immense frustration people have with the Internal Revenue Service (IRS). The IRS has been underfunded for decades. Their continuous underfunding leads to a lack of innovation. The IRS is running off outdated systems, creating an inefficient process for taxpayers. I believe that if the IRS can gain appropriate funding, the implementation of emerging technology would allow a more efficient experience for taxpayers.

In my career, I want to leverage the knowledge that I gained throughout this course to create a meaningful difference in society. In doing so, I will also change society’s view of who accountants are and what kind of work they do. Accountants will always be necessary for our society to function. However, as we say in class, those accountants that use emerging technology will replace those accountants that do not.