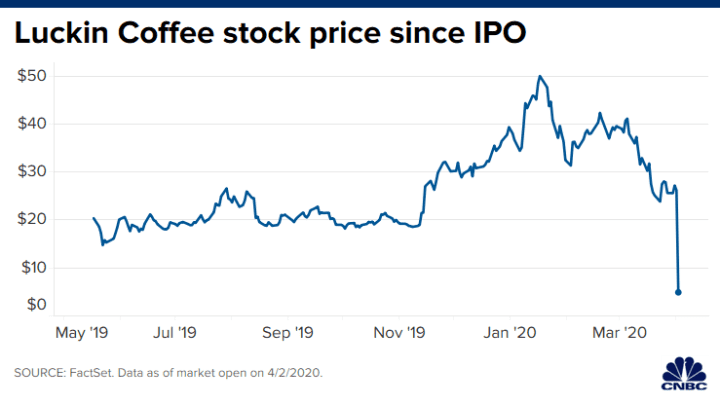

Everyone has heard of Starbucks, but have you heard of Luckin Coffee? Founded in 2017, this coffee chain, based in Xiamen, China, quickly rose in popularity. Soon after, it was the second-largest coffee chain in China after Starbucks. In a little over two years, Luckin Coffee opened 2,370 stores and sold 90 million cups of coffee. In 2019, it had a loyal customer base of 16.8 million customers. By March 2019, Luckin Coffee went public on Nasdaq. It initially raised $150 million in Series B funding. After filing its initial public offering, it hoped to raise an additional $510 million.

Luckin Coffee’s mission is “to be a part of everyone’s everyday life, starting with coffee”. Since the coffee market was pretty saturated, Luckin Coffee had to stand out. They decided to leverage their technology-focused approach. This technology-driven model allows them to produce a high-quality, low-cost, and convenient cup of coffee for its customers. Luckin is a 100% cashier-less chain. Their store network consists solely of pick-up stores and delivery kitchens. They also use a strong data-driven approach.

However, their quick success did not last long. After their stock price tripled in two months, people become suspicious of their true financial status. In April 2020, Luckin announced that their Chief Operating Officer fabricated their true sales amount by $310 million. This fraud led to being delisted from the Nasdaq. Their scandal showed that more had to be done to protect American investors since those in China could tell much earlier that Luckin was inflating its numbers. Luckin cared more about gaining customer volume than actual revenue-growing activities. They were creating fake revenue to attempt to meet the expectations of analysts and investors. They did this in numerous ways. For example, they used round-tripping practices and found companies to buy coffee in bulk. They would then buy back the coffee.

The U.S. Senate responded by passing a bill that would ban many Chinese companies from listing their shares on U.S. exchanges. Luckin translates to ruixing in Chinese which means happiness and luck. Ironically, luck was not on their side when the SEC hit them with a $180 fine.

I learned about this scandal while trying to research blockchain. In a study by Tianhao Chen, Chen performs a case analysis of Luckin’s scandal. He claims that blockchain can help prevent and deduct accounting fraud. Currently, in accounting, companies use a double-entry system. Chen argues there needs to be a third set of books that is independent and public. Blockchain can be used to create this triple-entry system. Fraud is often motivated by personal needs and the fact that they believe it will go undetected. Since blockchain would create a public record-keeping system, individuals would be more likely to be caught and thus less likely to commit fraud. Audits would also be easier with the use of blockchain. Auditors could trust their client’s information more, and the audit process itself would be cheaper. The Big Four Accounting Firms have already started making blockchain a reality for the accounting world. For example, Deloitte created Rubix, which allows customers to design their own blockchain-based applications.

Luckin Coffee’s fraud should have been caught earlier. Their sales grew by 90% in quarters three and four of 2019, while their inventory growth was approximately 23%. These contrasting rates of sales and costs should have been alarming. However, because of the number of stores and the high volume of daily orders, inventory inspection was difficult.

Chen claims that fraud happens for three reasons which he calls the fraud triangle. This model consists of motivation, opportunity, and rationalization. Blockchain has the opportunity to mitigate all of these aspects of fraud. By using a distributed ledger, the cost of a person or company fabricating their numbers becomes exponentially higher. To modify blockchain data, a group of miners would need to have control over 51% of the nodes. The necessity of 51% attacks would substantially increase the cost and decrease the motivation of fraud. Also, the opportunity for fraud would decrease with blockchain because it uses a linear transactional database. Companies’ databases would have to be relational, creating a better way to track data. Lastly, the rationalization for committing fraud decreases because smart contracts would serve as automatic controls. Think of smart contracts as code that tells the blockchain to execute in the terms of the contracts. It creates trust in both parties. Rather than relying on human action and decisions, smart contracts could allow accounting processes and audit procedures to be incorporated with accounting standards and requirements.

By using blockchain, investors can have trust in the transactions happening within a business. Fraud, like the Luckin Coffee scandal, would decrease drastically with the use of blockchain in the accounting field because it would create a stable, traceable, and efficient way of tracking transactions. It would also decrease the motivation, opportunity, and rationalization of fraud. The ability to detect and prevent fraud provides value to both investors and the financial market. Blockchain technology in accounting would reduce financial disclosure mistakes, increasing the quality of accounting data.

https://investor.luckincoffee.com

https://www.npr.org/sections/goatsandsoda/2019/05/17/723193259/what-does-chinas-luckin-coffee-have-that-starbucks-doesnt

https://www.cnbc.com/2020/07/06/investing-fraud-at-china-luckin-coffee-fraud-case-warning-for-investors.html

https://www.investopedia.com/terms/1/51-attack.asp

https://www.atlantis-press.com/proceedings/icssed-22/125973833

https://www.investopedia.com/terms/s/smart-contracts.asp