Housing market

When it comes to these blogs, I love speaking on topics that both keep readers informed on the current economy of the country along with giving them data that they can apply to their lives. Our topic today will be focused on the housing market and different factors that tie into it and explain the fluctuations that we have been experiencing.

First off, I want to talk about a real estate bubble so that you can somewhat understand why there’s been an uproar in the market. A real estate bubble is a temporary state of high prices usually because of high demand and low supply. This concept of supply is and demand serves as the foundation for markets and real estate is no different. This so-called bubble bursts when prices drop which can lead to a housing crisis which scares economists. Due to the fact that real estate takes some time to build, meeting the demand of the economy can take months if not years. This demand is usually fueled by population growth or a high immigration rate which the United States is vulnerable too.

Understanding interest rates is integral when inspecting the real estate market because people must borrow money in order to buy these houses. In simple terms, the interest rate is the amount a borrower is charged for the privilege of being loaned money. The United States Fed sets the interest rate which banks use to determine the APR, annual percentage rate, that they will offer to their borrowers. Central banks tend to increase the interest rate when inflation is high because higher interest rates increase the cost of debt, which discourages.

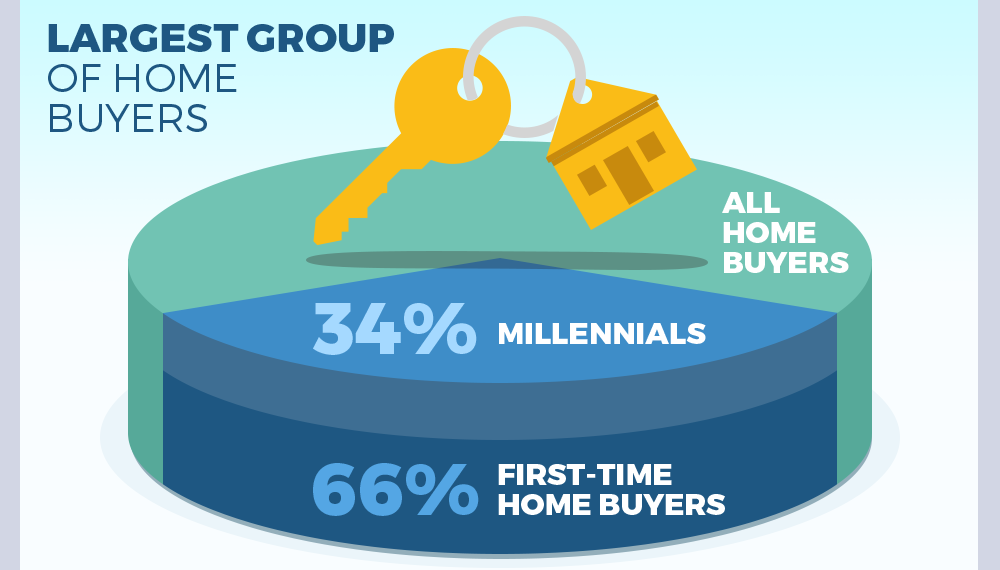

Another strong influence on the real estate market is the demographic makeup of its buyers. At about 78 million, millennials make up 40% of the home buying market. In prior years, this generation has been known to rent but a sudden change in the market has led them to buy these homes in order to establish their wealth. Despite the student loans, millennials and soon Gen Z are eager to be home owners which has created a strong demand in the market. Millennials are also the most likely to refinance their homes with a rate of 32% which is shocking when comparing it to the 9% for baby boomers. It seems that millennials take advantage of opportunities in real estate and are less risk averse than their older counterparts. This has benefitted them as they are the majority homeowners in the US and represent the backbone of the demand in the economy.

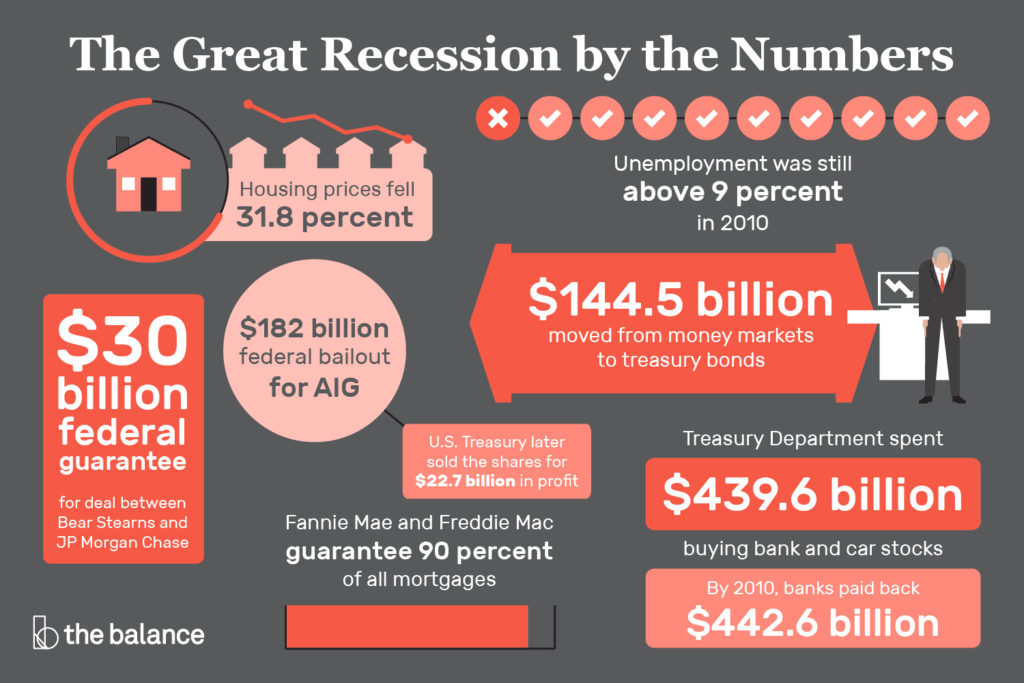

Now that we’ve seen what our current economy looks like, let’s reevaluate the 2008 housing crisis so that we can see where we went wrong. The 2207-2008 housing crisis gradually developed as home prices started falling in late 2006. This pandemonium began with cheap credit and lax lending standards that created a housing bubble. When the bubble burst, the banks were holding trillions of dollars of worthless investments in mortgages. Because the interest rates fluctuated from 2004-2008, buyers could not keep up and ended up defaulting on their loans and started to accumulate debt. This recession created a domino effect and obs were its first target. The unemployment rate rose to 6.9% in the fourth quarter of 2008 which affected the labor market for years to come. Countless acts of legislation were passed in order to better regulate financial activities and bail out important industries such as the labor market.

Another trend in the housing market that caught my attention was that house prices in the East versus the West are complete opposites. Some of the most expensive real estate markets in the country such as Los Angeles, San Diego, and the Bay area have seen a dramatic decline in the last few months while key cities in the East such as Chicago and Atlanta are enjoying home price gains. The regional pattern is not clear but economists have used data to predict what the underlying causes could be. Two factors are at work here, first off Eastern cities tend to have older housing stock which means more opportunity to expand housing through renovation of these homes. Western cities lack this and as a result tend to see booms when demand is strong but a sharp price decline when that demand decreases. The federal government also owns a good chunk of land in the west which determines how much cities can expand outward. Falling home prices can also be attributed to the pandemic which promoted the remote work trend. This can be assumed when looking at cities that have a huge presence in the tech industry such as Seattle, San Francisco, and Austin. Going back to my previous point that spoke on millennials acting as key drivers in homeownership, this can also be connected to the concept of remote work. Since Covid, employees in certain sectors have been able to work from home for a few days out of the week if not everyday. This is one of the primary factors in why millennials started buying more homes after the pandemic. I personally know individuals who live in places hundreds of miles away from their work office.

As our economy continues to change, individuals must be up to date on new trends and discoveries so that they can plan accordingly. The 2020 pandemic was a wake up call for many and we must be prepared for any change in the market, especially when it comes to real estate. Simply subscribing to a newsletter can give you all the information you need to keep your financial well-being intact.