For the past couple of years, a big name in technology has been cryptocurrency. Some popular ones like Bitcoin, Ethereum, and Dogecoin have all been in the market for nearly a decade now with fluctuating prices. FTX, a cryptocurrency exchange, emerged onto the scene as a major player operating as an exchange while having it’s own currency. FTX, short for Futures Exchange, quickly made it’s mark with sponsorships with Mercedes and its F1 team, NBA teams such as the Miami Heat, Golden State Warriors, and the Washington Wizards, Esports teams such as Furia and TSM in addition to Riot Games, and the MLB. FTX also signed major athletes to its brand such as Tom Brady, Steph Curry, Naomi Osaka, and Shohei Ohtani.

The Founding of FTX

Sam Bankman-Fried, the 30-year-old founder of FTX, was considered an upright entrepreneur and philanthropist for his desire to donate half of his wealth. The creation of FTX starts back in 2018 when SBF gained an interest in Bitcoin and began trading the cryptocurrency. He’d purchased Bitcoin in the US and sell it in Japan. With the profits made, SBF created his own cryptocurrency exchange in 2019, known as FTX. His primary focus was luring high-risk investors looking to place leveraged bets on cryptocurrencies. Venture capitalists flocked to the idea of FTX and shortly after was valued at $18 billion in 2021. As Isaac Newton once said “what goes up must come down,” however in this instance it was FTX as a company and not the apple Newton threw into the air.

How FTX hit the floor within the span of 10 days.

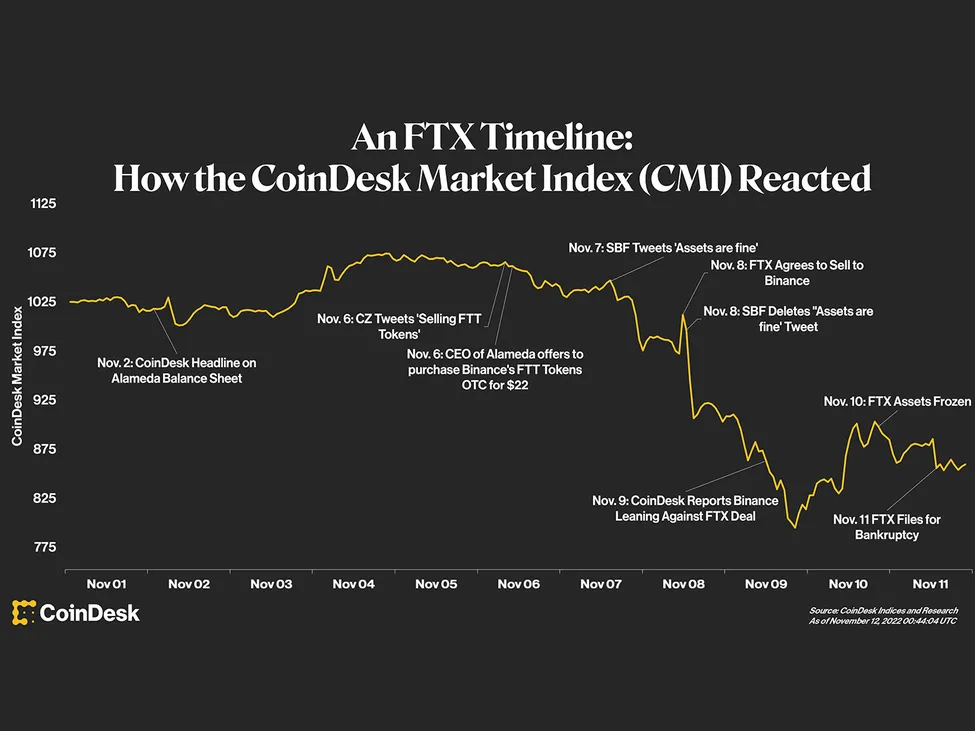

This all went downhill during the dates of November 2 to 11, 2022. On November 2, a leak of Alameda Research’s balance sheet was discovered by CoinDesk. The balance sheet speculated that FTX was printing tokens out of thin air. This report by CoinDesk highlighted potential leverage and solvency issues. On November 7, the crypto analytics company Nansen disclosed that over the past week over $451 million worth of stablecoin had been withdrawn from FTX. On November 8, Binance, a rival exchange, entered a letter of intent to buy FTX however on November 9, the deal would fall through. On November 10, SBF issued an apology on Twitter. Ultimately, on November 11, FTX filed for bankruptcy and over billions of dollars worth of crypto withdrawals were frozen alongside with the company. Throughout SBF’s reign in the crypto world, he attained a net worth just shy of $21 billion. Over the days of November 2 to 11, his net worth dropped by $16 billion. The demise of FTX? Not having enough assets in reserves to meet the demand of customers.

SBF would be arrested on December 12th in the Bahamas and extradited back to the US. 10 days later, a federal judge would grant him bond and he’d be out on a $250 million bond, the largest ever. On January 3, 2023, Sam Bankman-Fried plead not guilty to all criminal charges in a New York federal court.

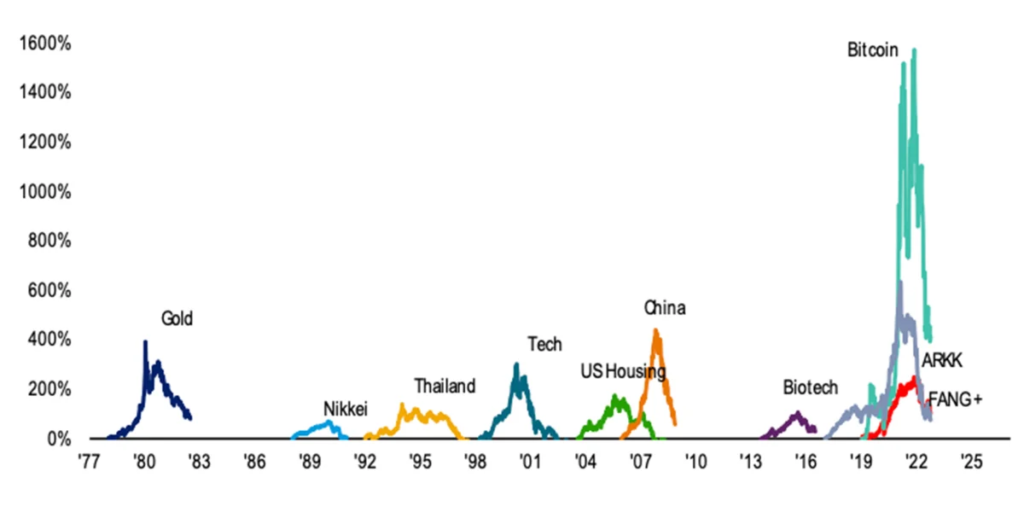

The fall of a major player like FTX led to a major crash within the crypto bubble. This crash would lead to Bitcoin plummeting down to $16,000, first time since 2020.

Is Crypto a sham?

Five months before the demise of FTX, Bill Gates described cryptocurrencies and NFTs as a sham. Stating that the trend of the digital assets are based on the “greater fool theory”. The theory falls on the idea that people are able to sell overvalued assets to a “greater fool”, someone who is willing to purchase the asset at an even higher price. Gates states he prefers “old fashioned investing”. However, old fashioned investing into companies may not always be the most ideal either – see Enron Scandal. Personally, I believe cryptocurrencies will not succeed and it’s just a matter of when they all bust.

Sources

https://www.investopedia.com/what-went-wrong-with-ftx-6828447

https://decrypt.co/114975/crypto-sports-marketing-deals-crumbling-cancelled-failed-ftx

https://www.forbes.com/sites/forbesstaff/article/the-fall-of-ftx/?sh=4a2dba577d0c

https://fortune.com/2022/11/11/crypto-bubble-bitcoin-fifth-biggest-all-time-bofa-ftx/

https://www.npr.org/2022/11/19/1138018369/the-rise-and-fall-of-ftx

https://www.reuters.com/markets/currencies/rise-fall-crypto-exchange-ftx-2022-11-10/

https://www.cnn.com/2022/06/15/tech/bill-gates-crypto-nfts-comments/index.html

https://www.forbes.com/advisor/investing/cryptocurrency/top-crypto-scams/