Venture Capitalism has a huge presence in the United States, the first VC firm was founded in the late 1940’s. Ever since, there have been a multitude of firms in order to promote startups and growth in various industries. I first learned about venture capitalism when I was a freshman in college and soon started to delve deeper into it as the concept is fascinating to me. It can be defined as money or technical expertise provided by investors to start-up firms with growth potential, this industry is not necessarily focused on profit or revenue as normal companies but more so what the future could look like. The investors are deemed “angel investors”, the term originated in Broadway theater when wealthy individuals donated to help with theatrical productions. These individuals have a higher risk tolerance when compared to the regular employee because of the capital they have to invest in the visions of others. It’s spectacular when one of these businesses stay in operation for an extended period of time because the failure rate is pretty high at 90%. Let’s put ourselves in the position of these angel investors for a second, they invest maybe $500,000 on average for one of these companies and can end up losing everything. This is on the lower end as I personally know people that have lost millions and nothing to show for it. It’s a tricky career path to pursue which is why many stick to what they know, a 9-5, but if you are willing to take on the risk, the rewards can be substantial.

Venture Capitalism exists to spur innovation and in fact is responsible for many of the devices and services that we are familiar with today. A few notable examples included Airbnb, Whatsapp, and Groupon. Even though many companies fail, there are some that prevail and have become shakers and movers in the market. There’s a multitude of reasons that a startup may fail such as changing market conditions, a flawed business plan, and even a weak foundational partnership. Another major reason may be having unqualified personnel such as your chief financial officer and chief operating officer. This is one area where your internal network is integral as you may have thousands or millions of dollars in investment with investors expecting a certain ROI. Top talent must be recruited and this is rarely ever done the traditional way. References can take you far when looking for employees who can help make your vision a reality. Speaking from personal experience, when you know someone that was in top management at a firm, they usually know others of the same caliber in different industries which is how strong networks are established. Not saying that normal interviews cannot be conducted when looking to hire but I would definitely say they aren’t a priority. The credentials of a particular someone isn’t the only requirement when hiring for a startup but their character and values must also be taken into account. Startups run into conflict and roadblocks pretty often and you want people around you to be vulnerable and transparent when the time comes.

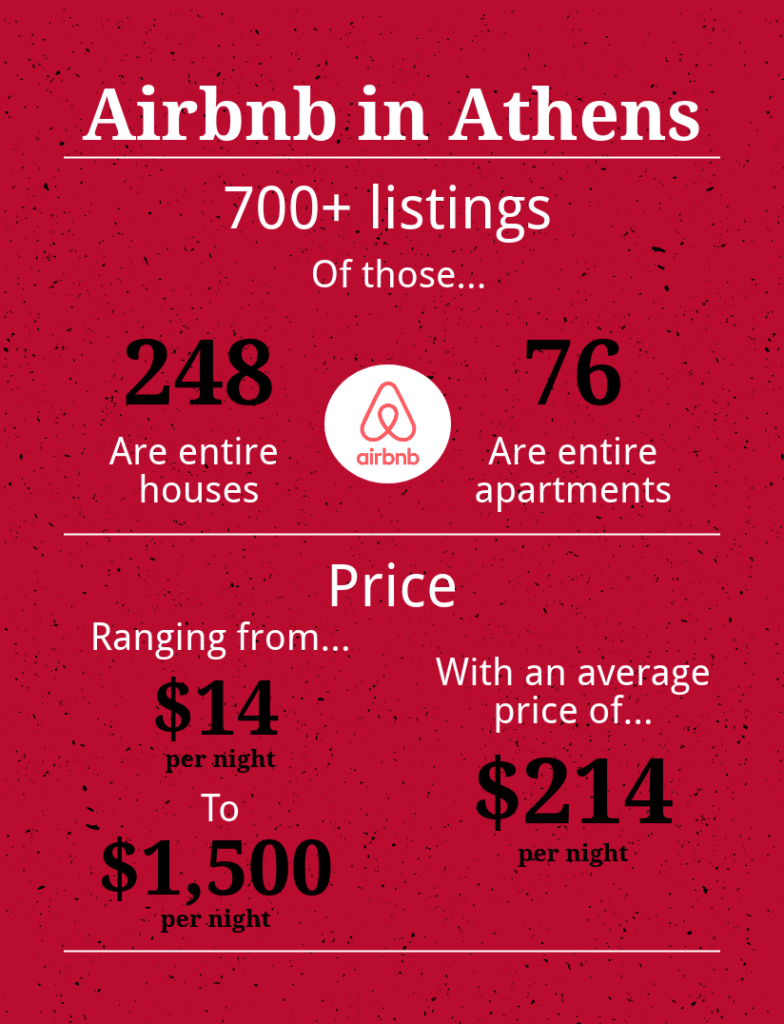

I mentioned Airbnb earlier and I want to speak a little more about it as it’s one of the most successful startups and I am fascinated with its business model. I read an article about the company a few years ago and the facts are still glued in my brain because of the situation the founders were in. In 2007, Brian Chesky and Joe Gebbia saw an opportunity and went for it! They were in New York when they noticed that a particular hotel was overbooked and there was nowhere for the less fortunate to stay so they bought airbeds and put up a site called Air bed and breakfast. This particular story stands out to me because people have run into the same situation and decided not to do anything about it but these two young guys did and created one of the top companies of the century. To raise money to fund their company, they were selling Obama cereal boxes during the 2008 election. They took initiative to raise capital and the timing was close to perfect and they had a whole $30,000 to show for it. Soon after, investors started to realize what the company could be and poured millions into it. Airbnb hahs 83 investors to date and this number continues to grow as the company becomes larger and continues to expand. The average Airbnb host made $44,000 in 2021 which is incredible when considering that it is a fairly new business. People make a living off of this business model and Airbnb takes roughly 3% of all bookings which comes up to a grandiose amount when looking at the number of bookings a year.

Venture Capitalism is focused in certain parts of the country such as New York, San Francisco, and Boston. These three areas online account for more than half of all VC offices in the country. Firstly, people flock to the regions because of the VC firms that have succeeded there in the past. Secondly, these regions are in states with higher than average levels of economic output per person. I’ve actually had the opportunity to experience the VC industry in San Francisco and I loved every detail about it. I went to the city in April of 2022 and was able to visit many local startups with newfound success such as Strava which is a physical activity social app. I was able to speak with the top management to learn more about what they face on a day to day basis and their methods for resolving as a small and upcoming company. One thing that stood out to me during the visit was that most of the employees were fairly young with no one being over the age of 35 which is pretty uniform across the industry. The environment was extremely lax and I depicted everyone as friends instead of coworkers which made me wonder how I would fit into working for a startup.

Venture capitalism seems like an attractive profession to me but I see it as an avenue to go down after your professional career is concluded. For example, I don’t visualize myself as an angel investor in my 30’s because I believe in building my financial foundation before donating thousands to arising companies. When I reach that point of financial freedom, I believe I will consider it as a path to pursue but I guess only time will tell.

https://corporatefinanceinstitute.com/resources/wealth-management/venture-capitalists/

https://www.businessnewsdaily.com/4252-venture-capital.html

https://getpaidforyourpad.com/blog/the-airbnb-founder-story/